when will capital gains tax increase uk

In that sense if you considered a resident the capital gains tax to be paid will. The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions.

Capital Gains Tax What It Is How It Works What To Avoid

The Capital gains summary form and notes have been added for tax year 2020 to 2021.

. Internal Revenue Service Revenue Procedure document 2021-45Figures represent taxable income not just taxable capital gains. Any gain above this is taxed at 18pc for a basic-rate taxpayer or 28pc for a higher-rate taxpayer. The rules governing the taxation of capital gains in the United Kingdom for individuals and companies are contained in the Taxation of Chargeable Gains Act 1992.

Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. Avoiding a capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first 250000 if your tax-filing status is single and up to. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

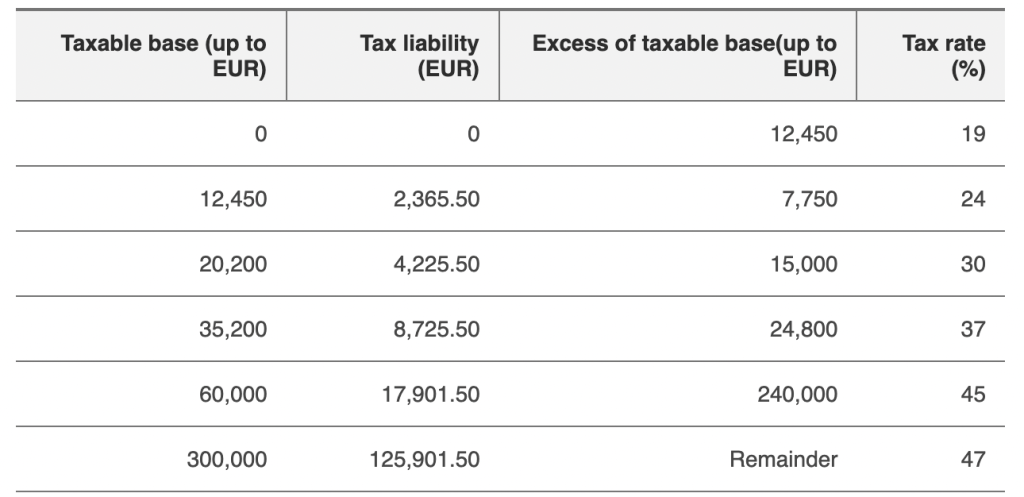

The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. Just as a reminder you will be considered a tax resident in Spain if you stay in the country for more than 183 days per year 6 months. Non residents pay capital gains tax of 25 of the profit capital gain realized on the sale so long as the payment is accompanied with the Application for a Clearance Certificate Form T2062.

22 May 2020 Helpsheets HS307 Non-resident Capital Gains for land and property in the UK and HS308 Investors. There is an annual allowance of 12300. To calculate your tax liability for selling stock first.

You may be able to file an election with the IRS to increase the cost amount of your property to its fair market value on the date that you became. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. If your income falls in the 40400441450 range your capital gains tax.

Capital Gains Tax for Spanish residents. Add this to your taxable income. Was extended through 2010 as a result of the Tax Increase Prevention and Reconciliation Act signed into law by President Bush on 17 May 2006 which also reduced the 5 rate to 0.

First deduct the Capital Gains tax-free allowance from your taxable gain. Capital gains tax rates for 2022-23 and 2021-22. Long-term capital gains on so-called collectible assets.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Yield Cgy Formula Calculation Example And Guide

Difference Between Income Tax And Capital Gains Tax Difference Between

What Are Capital Gains Tax Rates In Uk Taxscouts

Capital Gains Tax On Separation Low Incomes Tax Reform Group

60 Day Capital Gains Tax Reporting For Residential Property Disposals Saffery Champness

Get Ready For 178 Billion Of Selling Ahead Of The Capital Gains Tax Hike These Are The Stocks Most At Risk Marketwatch Capital Gains Tax Capital Gain Tax

Tax Advantages For Donor Advised Funds Nptrust

Portugal Capital Gains Tax When Are You Liable And How Much Do You Pay

Difference Between Income Tax And Capital Gains Tax Difference Between

Spain Cryptocurrency Tax Guide 2022 Koinly

Capital Gains Tax What Is It When Do You Pay It

A Complete Guide To Capital Gains Tax Cgt In Australia

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax